are charity raffle tickets tax deductible

Exempt under section 501 of the Internal Revenue Code. Not all charities are DGRs.

Tax Deductible Charities Tax Deductible Donations Irs 526 Tax Deductions Charity Donate

The organization may also be required to withhold and remit federal income taxes on prizes.

. The donor must be able to show however that he or she knew that the value of the item was less than the amount paid. Because of the possibility of winning a prize the cost of raffle tickets you purchase at the event arent treated the same way by the IRS and are never deductible as a charitable donation. This is because the purchase of raffle tickets is not a donation ie.

Unfortunately fund-raising tickets are not deductible. Raffle tickets are not deductible as charitable contributions for federal income tax purposes. The cost of a raffle ticket is not deductible as a charitable contribution even if the ticket is sold by a nonprofit organization.

The IRS regulates games of chance too as well as the taxable income that is earned by victorious game-players. Donors who purchase items at a charity auction may claim a charitable contribution deduction for the excess of the purchase price paid for an item over its fair market value. If you get something in return for your donation such as a raffle ticket thank-you card or ribbon its not considered a gift and you cant claim it.

Ad Free For Simple Tax Returns Only With TurboTax Free Edition. With TurboTax Its Fast And Easy To Get Your Taxes Done Right. For specific guidance see this article from the Australian Taxation Office.

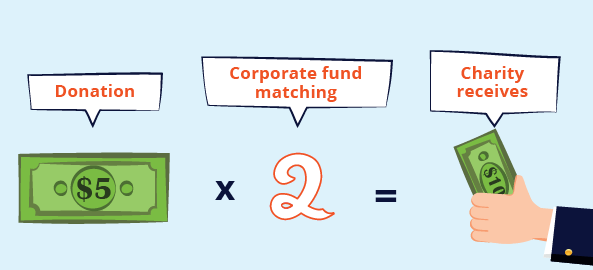

If you receive a benefit from making a donation you can only deduct the amount of your donation that is greater than the value of the benefit you receive. In the case above it would say 150 of the ticket price may be tax deductible BRANCH XXX ANNUAL FUNDRAISING DINNER DANCE TICKET PRICES 60 of the ticket is value of the dinner and is not tax-deductible 1000 Ambassador level- includes dinner for 2 880 tax-deductible. Tuition or amounts you pay instead of tuition.

The IRS classes money spent on raffles and lotteries as contributions from which you benefit and therefore it is generally not deductible. Buying a ticket lets you help your community but it doesnt help you claim a deduction for a charitable donation. When you purchase a ticket to a charitable fundraising event such as a dinner some or all of the price you pay can be a deductible donation as well.

The portion of the admission or ticket price that equals the value of goods or services the donor receives at the event is not deductible. The IRS considers a raffle ticket to be a contribution from which you benefit. To determine if a charity has DGR endorsement visit the ACNC Charity Register.

For example in recent times crowdfunding campaigns have become a popular way to raise money for charitable causes. The IRS considers a raffle ticket to be a contribution from which you benefit. There is the chance of winning a prize.

You cant deduct as a charitable contribution amounts you pay to buy raffle or lottery tickets or to play bingo or other games of chance. General Requirements Before you can deduct the cost of your charitable dinner ticket or any other charitable donation the organization hosting the event must have tax-exempt status. Tax preparers frequently find themselves presenting bad news to clients seeking charitable deductions for bingo games raffle tickets or lottery-based drawings used by organizations to raise money.

When you locate the charity youre interested in open their Charity Register page and in the right-hand corner there will be an icon that asks Will my donation be tax deductible. Payment for raffle or lottery tickets including 100 clubs the payment to purchase a raffle ticket from a charity is not a. If you win the raffle you may even end up owing tax.

The cost of a raffle ticket is not deductible as a charitable contribution even if the ticket is sold by a nonprofit organization. Chapter 345 of HMRCs Gift Aid guidance states. Is a raffle ticket considered a donation.

For example a charity may publish a catalog given to. If it does it is likely your nonprofit will need to apply for a license from the state beforehand. Your state may or may not permit charitable nonprofits to conduct raffles Bingo auctions and other games of chance.

For example the following cannot come within the Gift Aid Scheme. For example if the ticket price is 100 and the fair market value of the food andor entertainment received at the event is 25 per donor the portion of the ticket price that is deductible as a charitable contribution is 75. Donations to crowdfunding appeals often arent tax deductible because you often get some reward the fundraising might be for a number of people or groups or its for medical costs.

The irs doesnt allow a charity tax deduction for raffle tickets you purchase a part of a charity fundraiser because it treats the tickets as gambling losses. A tax-exempt organization that sponsors raffles may be required to secure information about the winners and file reports on the prizes with the Internal Revenue Service. The irs has adopted the position that the 100 ticket price is not deductible as a charitable donation for federal income tax purposes.

When you purchase a book of raffle tickets from a charity you are receiving something of material value in. Portion which may be tax deductible. However many of these crowdfunding websites are not run by DGRs.

The IRS has determined that purchasing the chance to win a prize has value that is essentially equal to the cost of the raffle ticket. This means that purchases from a charity that involve raffle tickets items or food cannot be claimed as tax deductible gifts. Dues to fraternal orders and similar groups.

Get Your Max Refund Today. A deductible gift recipient DGR is an organisation or fund that registers to receive tax deductible gifts. However raffle tickets are not tax deductible regardless of whether the community or charitable organisation has Deductible Gift Recipient status.

Payments to a charity in return for services rights or goods are not gifts to charity and so are not eligible for the Gift Aid Scheme.

Fun Fact Charity Raffle Tickets Are Not Tax Deductible

Tax Deductible Donation Receipt Template Using The Donation Receipt Template And Its Uses Donation Rece Receipt Template Letter Template Word Donation Form

Are Raffle Tickets Tax Deductible The Finances Hub

Fun Fact Charity Raffle Tickets Are Not Tax Deductible

Letter For Donations Raffle Basket Ideas Hurray Donation Throughout Donation Card Template Fr Donation Letter Donation Request Letters Donation Letter Template

Are Nonprofit Raffle Ticket Donations Tax Deductible Legalzoom Com

Tax Deductible Donations An Eofy Guide Good2give